Risk management focuses on reducing the impact that risks have on a business. It can be a long and complicated process that requires identification, evaluation, prioritisation and treatment. However, strategies alone are not enough. Organisations need to have the tools to ensure that they manage risk effectively. During the different stages of the Enterprise Risk Management (ERM) process, various tools can be utilised to satisfy the specific needs of the company.

Benefits of knowing how to manage risk

Employers should know how to manage risk as running a business is not an easy task. Using risk management tools can increase the probability of success as threats are controlled before they affect operation. Managers will expect the unexpected and deal with problems that occur in the correct priority order.

Risk management can minimise costs as injuries and cases of mishandling will reduce. It can ensure that managers are prepared to deal with different possibilities that may arise. The larger the company the more complex it is, which can make it difficult to keep track of everything. Tools provide guidance to manage risk and help the organisation survive. They can assist in uncovering risks that are not apparent and build a better defence against future threats.

Risk management tools

- SWOT Analysis

- Root cause analysis

- Risk assessment

- Risk matrix

- Risk register

SWOT Analysis

SWOT stands for strengths, weaknesses, opportunities and threats. This tool can help with identifying strengths a business has and help managers discover any organisational weaknesses or internal and external threats that might be present. Employers will be able to analyse risks that they have control over and risks that they cannot control. For example, it might be identified that a lot of responsibilities are given to a single employee, something that can damage the business in the long term as the employee may leave.

A SWOT analysis can be performed as frequently as the business deems necessary. Looking at strengths, weaknesses, opportunities and threats allows managers to have a better idea of what the business can do and in which areas it is vulnerable. They can then prioritise weaknesses and threats that they are not capable of addressing and define strategies to manage risk.

Root cause analysis

A root cause analysis involves the identification of the ‘root’ of an incident that occurred. It is a concept mostly used in IT incidents but can also be used in other areas such as projects. A root cause analysis is useful for workplace safety incidents and its goals can be adjusted – to fit different situations according to the needs of a company. It attempts to go beyond the superficial cause of a problem and get to the root cause. In some instances, it might seem that the problem is poorly labelled equipment while the underlying issue could be the lack of training or a gap in policy.

This is why the root cause analysis is helpful in determining what happened, how it happened and why it happened. By doing a root cause analysis, you can identify the risks of similar incidents occurring in the future, and manage those risks to prevent them from occurring again.

Risk assessment

A risk assessment helps businesses identify, analyse and control risks and is usually conducted by an experienced employee. Once all risks have been identified the business will be able to come up with measures to address the threats and eliminate or reduce the risk. For example, it might be used to assess cyber risk, a very common threat in today’s world. The way risk assessments are conducted depends on the type and size of business, the industry and the laws and regulations that apply to the business.

A risk assessment is important as it raises awareness of the hazards in the company and who might be vulnerable. It can highlight whether the business is prepared to face a risk or if it has adequate resources to handle future threats. It can guide decision-making and give a better understanding of which agreements or projects an organisation can take to manage risk effectively. A successful risk assessment relies on good communication between employers, managers and the rest of the employees.

Risk matrix

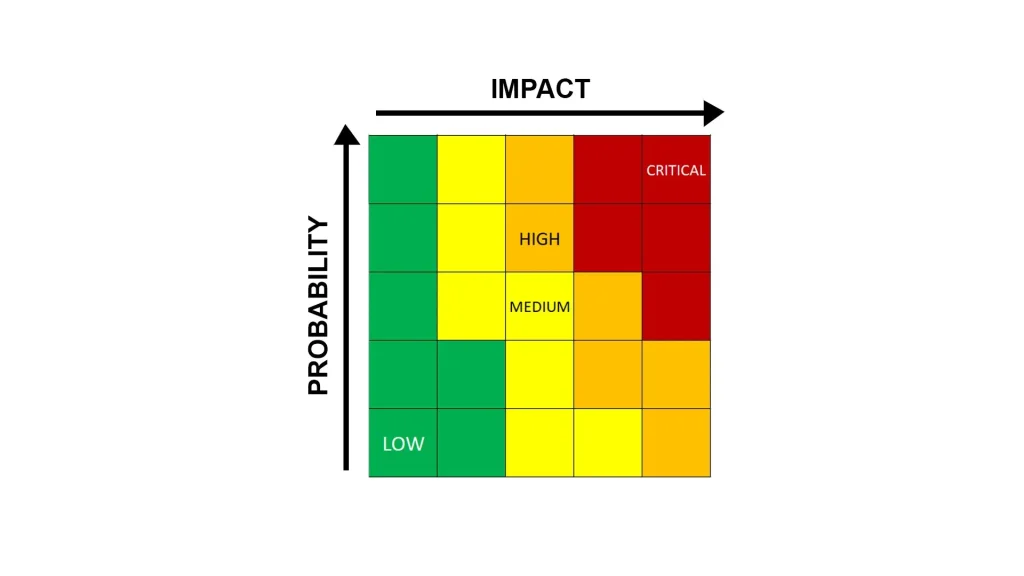

A risk matrix is a visual tool with which businesses can present the severity of risks in a diagram. It can be a helpful tool that can be used to manage risk within different-sized companies. The risks are depicted separately in each box according to the likelihood and severity of the risk, and the colours represent how urgently an organisation needs to address them. Before constructing the matrix managers need to undertake risk analysis and evaluation to determine the likelihood and impact of each scenario.

Due to its simplicity, the matrix can convey the importance of its risk, even to employees who are not familiar with the details. It can be created easily using Excel and the colours usually used are green, red, yellow and orange. However, the lack of details it provides can also be used as a weakness. It can also highlight the effectiveness of current controls and show where changes need to be made.

Risk register

This tool is a document used in risk management to record identified risks in the business. It is usually used for projects, as it assists with tracking potential risks, analysing them and coming up with measures to treat the risks by reducing or eliminating them. A risk register can be very helpful in ensuring regulatory compliance and is very easy to construct using Word or Excel along with other software. It can end up looking like a log as it tracks current and future risks that could potentially materialise. All the information can be stored in one document so the data is easily accessible so it is easier for managers to determine how to manage risk.

Conclusion

Managers should know how to manage risk and be prepared to deal with various scenarios. Understanding the magnitude of the risk is essential for communicating the strategies that will be used to control it. Different tools will be required depending on the situation. Some tools might provide more benefits than others but they all have the same purpose: making businesses aware of threats and providing tools to treat them. New risks will always emerge but it is important to be prepared and educated to manage risk effectively.

Let's Get Started

Interested in learning more about how Polonious can help?

Get a free consultation or demo with one of our experts

Eleftheria Papadopoulou

Eleftheria has completed a Bachelor's of Business with a major in Marketing at the University of Technology Sydney. As part of her undergraduate studies she also obtained a Diploma in Languages with a major in Japanese. Following her graduation she has been working as a Marketing Coordinator and Content and Social Media Specialist.

Eleftheria is currently finishing her Master in Digital Marketing.