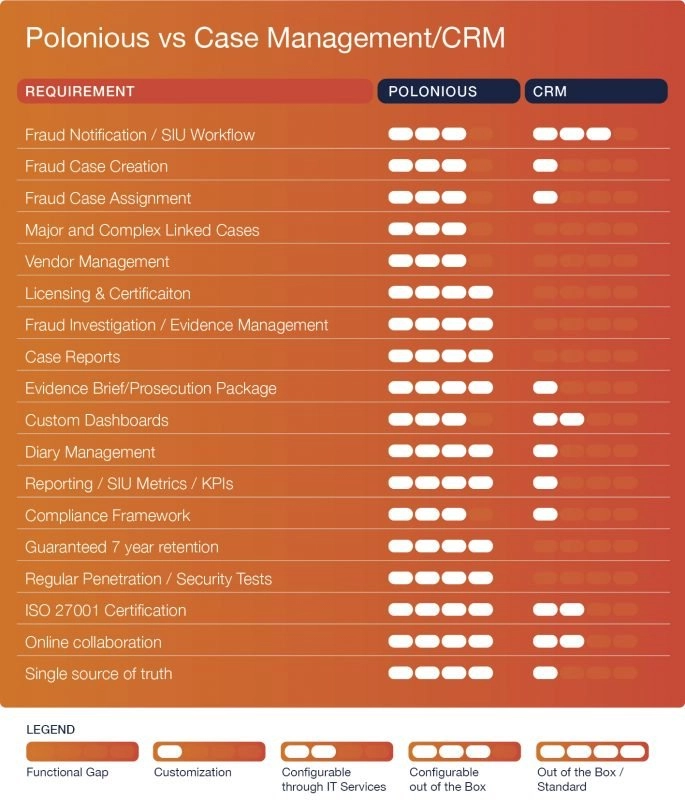

In part four of this blog series, counting the benefits of dedicated investigation systems, we will look at why company CRM systems are best used for customer relations and not fraud investigations. Customers are invariably involved in any investigation, but CRM systems are not designed, and lack the supporting information for, proper investigation management.

Let’s take a look at the typical challenges organisations face with CRMs for investigations and the steps you can take to move to a purpose-built application like Polonious.

First stop, the CRM

Organisations typically end up using CRMs for case and investigation management because investigations involve customers and the CRM is already available, either as part of an existing application portfolio or as a SaaS app

On the surface, a CRM seems a fairly natural fit for case management as you can collect a lot of information relating to a customer, including: communication records; personal data; organisation data; notes; and to some extent documents. Where CRMs do not fit is with managing complex processes and compliance matters, which are very specialised to investigations management.

The investigative limits of CRMs

What are the main drawbacks of using a CRM for investigations? The first is CRMs lack investigative focus. CRMs are people focussed and, although people are central to most investigations, they are not the centre of the investigation itself.

In contrast, process is the centre of all investigations: The why, when, who, what, where and how and the evidence to prove all these elements are the centre of an investigation.

In addition, the investigative process needs to be fair and compliant, which is already well beyond what can be achieved in a CRM

Another problem arises when CRMs and investigations management are attempted to be used together.

A customer is definitely one role in an investigation, but the subject and all the witnesses are too, and they all need to be treated according to law, not the customer’s wishes.

Don’t count on customisation

CRMs can be customised, so why can’t you just add onto, or customise, your CRM for investigations?

The problems with customisation include:

- Industry knowledge: It takes time and experience to gather the right information needed to conduct an investigation properly.

- Skills: Customising a CRM will require the skills to do it properly.

- Maintenance: Any technical or process changes, including compliance, must be continuously maintained, which can be a huge time and cost burden in the long term.

We’ll also cover more problems with customisation and the DIY approach in another blog.

Moving up to dedicated investigations management

Organisations can take steps to migrate to case and investigation management from a CRM, and benefit from a more structured and purpose-built application like Polonious.

These include:

- Map out your processes from start to finish

- Overlay these with all the regulatory requirements that need to be met

- Then include the reporting requirements and evidential requirements

Then your teams will start to see why a dedicated investigation management solution is a far superior option than trying to work with a CRM.

Polonious also provides all the CRM needs in relation to your customer, whether they are external or internal. And Polonious can help you report back to customers on KPIs as required.

It is also important to ensure the investigative activities undertaken are within the required legal or regulatory requirements and that all actions and evidence collected is available for future reference. Polonious does this as well.

Investigation management has elements of CRM in it, but conducting a proper and compliant investigation is vastly different when you consider the task more holistically.

Let's Get Started

Interested in learning more about how Polonious can help?

Get a free consultation or demo with one of our experts

Polonious Team

Polonious is a market-leading case and investigations management application, which is designed to improve business workflow, while keeping up with the constantly changing regulatory environment.