There are many systems available that help identify potential fraud. Many of them do a great job by using a combination of well-established rules discovered over the years by investigation units. Others do this by employing machine learning where results from prior investigations are ingested and attributes attached to them and those attributes are used to identify similar claims. More recently, there’s been a move towards using artificial intelligence to assist in identifying potentially fraudulent claims.

The challenge with all these systems is that they do not prove anything.

In part two of this blog series, counting the benefits of dedicated investigation management systems, we will look at why computer-generated fraud investigation can pose problems for real-world investigation teams.

1. Misconceptions with AI

A common misconception with AI is that the claims identified through these systems constitute fraud discovery. Moreover, this discovery process can include claims by some proponents of AI that they have saved “x dollars” in fraud simply by identifying potential fraud.

The reality is until any of these systems, or artificial intelligence, have reached the sentient point they can sit in a courtroom, swear on a Bible and give evidence acceptable to the court as evidence of fraud all they have achieved is identifying indicators of fraud.

Whether your fraud indicator has come from a comprehensive system; a whistleblower form on a public website; a report from a staff member or any other source; what happens next is an actual investigation.

2. Really proving fraud and false positives

Most investigations will not find incidents of fraud. Not always because there was no fraud, but because to prove fraud there must be evidence found that is admissible either in court or an appropriate arbitrator that proves fraud was committed. And this must include all the supporting elements of that allegation either on the balance of probability or, in the case of a crime, beyond all reasonable doubt.

All the AI and automation resulting in “computer says no” does not cut it in the real world. Following this approach alone exposes you to legal action and significant reputational damage to your organisation’s brand.

Another potential computer-generation problem is “false positives”. A computer indicating fraud detection when there really wasn’t is an example of a false positive. These still require effort by investigators to discount the false positives and it is critical that these are tracked and used to improve the source system. False positives can overload investigators and the potential benefits of AI are never fully realised

It is worth noting that in Australia the new General Insurance Code of Practice (GICoP) now required insurers with these systems to review them annually, as per section 195, to ensure they are not discriminatory and are relevant.

3. The human touch

Investigations require humans and the things that all professional investigators need to ensure they bring to the table include:

- Compliance with all state and federal laws in addition to any industry legislation or guidelines when conducting the investigation.

- Ensure all evidence collected is accurately recorded, secured and provenance documented.

- Authority for access to any private information is obtained, recorded and used appropriately.

- Due process is followed in relation to all the enquiries that are conducted.

- The subject of investigation is assured of procedural fairness throughout the investigation.

- The investigation will be conducted in a timely manner.

- All investigators will be appropriately qualified, licensed and insured.

- Roles and responsibilities are assigned.

- Performance metrics are recorded for reporting.

- All decisions, actions and evidence are reviewed, double-checked and recorded.

- All actions and notes are recorded as close to real-time as possible to ensure they are contemporaneous in the eyes of the court.

- All the above needs to be collated into a brief of evidence supporting any allegation.

- Only if all the above are followed and kept in place do we have an acceptable case to present and support the allegation of fraud.

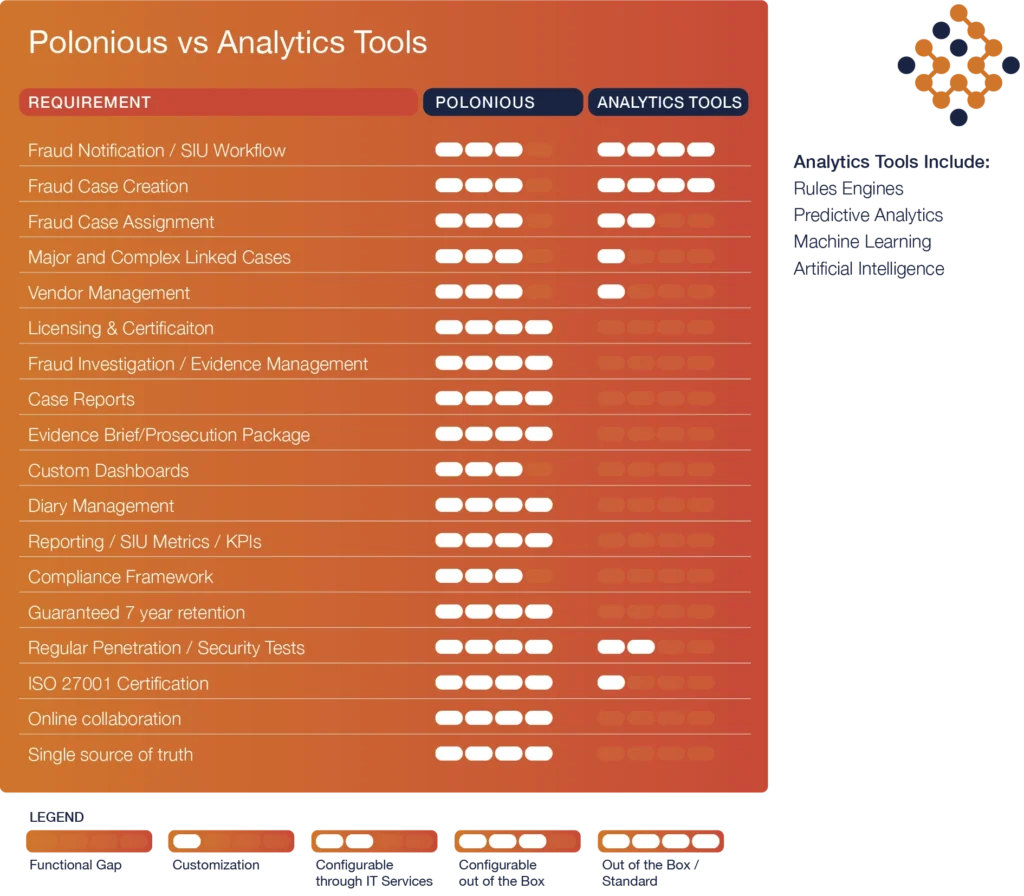

Polonious Systems goes well beyond a detection system for SIU investigations. Polonious will integrate with what systems you already have, but also solve all the problems discussed above. In addition, deploying Polonious Case Management software will place a minimal burden on your IT department.

Learn more about Polonious Systems here.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

Let's Get Started

Interested in learning more about how Polonious can help?

Get a free consultation or demo with one of our experts

Polonious Team

Polonious is a market-leading case and investigations management application, which is designed to improve business workflow, while keeping up with the constantly changing regulatory environment.