Risk assessment: A procedure that is necessary for every workplace as there are myriad risks related to running a business. There are threats and opportunities within the market. Owners know that regardless of the type or size of their business, they will have to face risks. Sole traders, partnerships, small, medium or large companies – all of these businesses will struggle with uncertainty.

Individuals should seek to understand the extent of the risks and try to minimise it. Becoming aware of the possibilities that could pose danger is crucial for the long-term success of the business and its stakeholders. Setting goals before conducting a risk assessment is also beneficial as it helps in keeping the procedure more organised. Today, businesses face many types of risk, including compliance, cyber and technological risks. A risk assessment can assist businesses in identifying them and

What is a risk assessment?

A risk assessment identifies and assesses the hazards that could negatively affect the ability of a business to run effectively. Some risks could be small and have a small impact on an organisation while others could be significant and cause serious problems within a business. While the risk assessment will not be able to minimise all of the risks it can assist in developing strategies to address the most important ones. This will help the business run safely and with fewer costs.

A risk assessment will outline:

- Which department/area of the business is impacted

- What the source or cause of the risk is

- What strategies will be needed to minimise the risks

The business will need to allocate resources to the risk assessment and its strategies to decrease the effect of risks in its operations. This will ensure that greater damage is avoided.

Identifying the risks

Every business needs to be proactive with regard to risk identification so it can be prepared to avoid current and future dangers. An establishment can be exposed to risk in more than one area, which includes the internal and external work environment. Stakeholders might be consulted to help with identifying potential risks and assisting in their analysis.

Some types of risk include:

Compliance

Owners need to be aware of any laws and regulations that are relevant to their business. Law is constantly evolving; new laws are being made and old legislation is being updated or becoming obsolete. A business needs to keep track of those changes to make sure it is complying and adapting to the changing legal environment. Failure to do so could result in a hefty fine, which was the case for USAA.

Security and fraud

Data breaches and cyberattacks are common today due to advances in technology and how much of our operations have moved online. When customers share their data with a business, they expect that it will be protected and stored safely. Fraud is also an important risk as it can occur from an internal or external source.

Financial risk

Market changes, currency fluctuations and rates increasing are all associated with the finances of a business. To avoid losses, the owners should always assess the economy and manage their investments effectively so revenue and asset losses do not occur. They should also keep track of debt to ensure that there is enough business cash flow to support further borrowing.

Risk analysis

Owners should analyse how the risks are affecting the business. They need to evaluate which assets are impacted, how big the impact is or how big the impact could be in the future. They need to find the source of the danger and how it could pose harm to their business. Moreover, they need to decide which risks they need to focus on. There might be various threats within an organisation, but identifying the one that is more likely to materialise and influence business activities is a crucial decision.

Depending on the type of risks that have been identified, the business can choose to look at different documents during its analysis. These consist of cash flow statements, legal acts or data policies. A strong analysis will help in taking action toward mitigating current and future risks. There are types of risk analyses, such as quantitative or qualitative, but it will be different for every organisation based on the kind of business they are conducting and the risks that have been identified.

With every risk analysis, there is a margin of error which could mean that the effect of a threat has not been correctly predicted or calculated. This is why the analysis needs to be extensive and thorough.

Control measures

Risk control measures refer to tools and actions aimed at preventing or minimising risks. These measures are designed to address the findings of the risk identification and analysis and present a fitting solution to the problem. There are many types of control measures with the most common being training, new equipment, rules and procedures. Depending on the nature of the risk, if it is tangible or intangible, the owners need to consider which control measures are the most effective for their business.

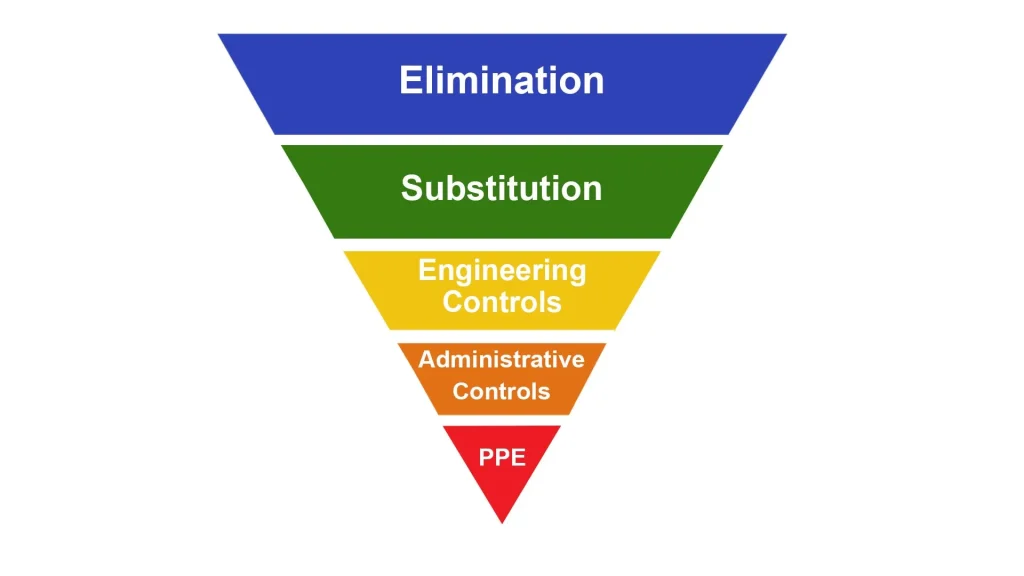

Some risk assessments might follow a hierarchy of steps:

- Elimination

- Substitution

- Engineering controls

- Administrative controls

- PPE (Personal protective equipment)

Elimination focuses on completely removing the risk from the workplace. This approach is always the most preferred because it offers the most protection.

Substitution is the next step when elimination does not work or is not applicable. It tries to replace the risk by implementing a safer alternative. However, it is not always as effective as elimination. An example of substitution involves replacing cleaning solutions so employees will not be exposed to toxic chemicals.

Engineering controls refer to the redesign of risks, such as implementing new software for increased safety, to reduce or remove a risk.

Administrative controls involve the provision of training, developing guidelines and setting employee assignments. Those can be designed to make employees familiar with SafeWork practices and how their desks should be set up to benefit them and avoid injuries.

PPE (Personal protective equipment) is the last step of the hierarchy. It requires employees to use or wear protective equipment to keep themselves safe. This can include face masks, high visibility clothing and protective gloves.

Review of control measures

Undertaking a risk assessment is an action that owners should commit to depending on the needs of their businesses. Control measures also need to be reviewed and updated if the risk is changing or if the measures are deemed ineffective. Over time the chance of a risk materialising might increase and have a higher impact on the business. Control measures will need to change to cover the different likelihoods and impacts and protect the establishment.

Conclusion

A risk assessment is essential to avoid injury, unnecessary costs and protect employees. There are many steps involved in a risk assessment and employers need to make sure that they address each step and are prepared and organised. The assessment could be expensive, but the advantages outweigh the disadvantages that may incur even higher future costs.

Let's Get Started

Interested in learning more about how Polonious can help?

Get a free consultation or demo with one of our experts

Eleftheria Papadopoulou

Eleftheria has completed a Bachelor's of Business with a major in Marketing at the University of Technology Sydney. As part of her undergraduate studies she also obtained a Diploma in Languages with a major in Japanese. Following her graduation she has been working as a Marketing Coordinator and Content and Social Media Specialist.

Eleftheria is currently finishing her Master in Digital Marketing.